The implementation of a mileage tracker offers significant advantages for both personal and professional travel management.

By leveraging advanced GPS technology, these tools not only enhance the accuracy of mileage logs but also streamline the tracking process, reducing the potential for human error. Furthermore, the time-saving benefits associated with automated trip logging can lead to improved organization and more effective financial oversight.

As we explore the multifaceted benefits of this technology, it becomes evident that the implications extend beyond mere record-keeping, potentially transforming how individuals and businesses approach travel-related expenses.

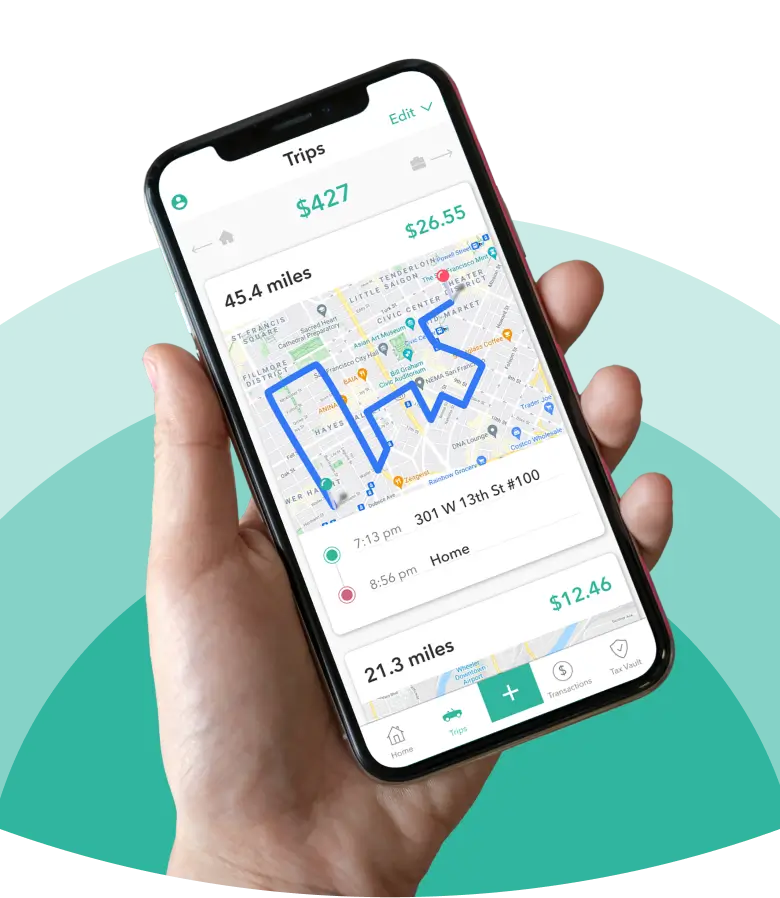

A streamlined approach to mileage tracking can significantly enhance efficiency for both individuals and businesses. By utilizing dedicated mileage tracking tools, users can automate the process of recording trips, minimizing manual entry and reducing the potential for errors.

This simplification allows for real-time tracking, where users can log their journeys with just a few taps on their mobile devices. Furthermore, automated tracking eliminates the need for cumbersome paper logs, making documentation easier to manage and access.

This efficiency not only saves time but also allows for better organization of travel records, which can be crucial for tax deductions and reimbursement processes. Ultimately, simplified mileage tracking contributes to improved productivity and peace of mind for users.

Many users find that enhanced accuracy in mileage tracking is a significant advantage of using dedicated tools. These specialized applications utilize GPS technology and automated data collection methods to ensure precise mileage logs, minimizing the potential for human error.

By automatically recording distances traveled, users can trust that their mileage reports reflect actual usage rather than estimates or inaccuracies that can arise from manual entry. Moreover, these tools often include customizable settings to account for varying routes and specific business needs, further refining accuracy.

Enhanced accuracy not only promotes transparency and accountability but also aids in ensuring proper reimbursements and compliance with tax regulations. Ultimately, this precision supports better financial management and operational efficiency for individuals and businesses alike.

Efficiency is a key advantage of using mileage tracking tools, as they significantly reduce the time spent on manual record-keeping. With automated tracking systems, users can effortlessly log their trips without the need for pen and paper.

This technology eliminates the tedious process of compiling mileage data at the end of the month or year, enabling users to access real-time insights instead. Moreover, many mileage trackers integrate seamlessly with smartphones and GPS systems, ensuring that every mile is documented accurately and promptly.

This instant access to organized records not only streamlines the documentation process but also fosters better time management, allowing individuals to focus on more pressing tasks. Overall, the time-saving benefits of mileage trackers are invaluable for busy professionals.

Leveraging mileage trackers can significantly maximize tax deductions for individuals and businesses alike. Accurate logging of business-related mileage is crucial, as the IRS allows deductions based on the number of miles driven for work purposes.

By utilizing a mileage tracker, users can ensure all eligible trips are recorded, minimizing the risk of missed deductions. Additionally, these tools often categorize miles driven for various purposes-such as client meetings, travel, or deliveries-providing clear documentation during tax filing.

This meticulous approach not only enhances accuracy but also simplifies potential audits. Ultimately, by maintaining precise records of mileage, taxpayers can substantiate their claims and potentially reduce their overall tax liability, thereby maximizing their financial benefits come tax season.

One of the standout advantages of modern mileage trackers is their seamless integration with various applications. This compatibility enhances usability by allowing users to sync their mileage data with popular accounting and expense management software.

Consequently, this integration streamlines financial record-keeping processes, reducing the time spent on manual entry and ensuring higher accuracy in reporting. Many mileage trackers also connect with navigation and calendar apps, enabling automatic trip logging based on scheduled appointments or routes.

Additionally, some applications offer cloud storage options, allowing users to access their data from any device, ensuring flexibility and convenience. This interconnectedness not only simplifies tracking but also empowers users to manage their expenses more effectively, ultimately leading to improved financial oversight.

The ability to generate real-time reporting is another significant benefit offered by modern mileage trackers. This feature allows users to access up-to-date information about their mileage and travel activities instantly.

By leveraging GPS technology and mobile applications, these trackers provide accurate data on distance traveled, routes taken, and time spent on the road. Real-time reporting empowers users to make informed decisions while on the go, ensuring they can adjust their routes or schedules as needed.

Additionally, it simplifies the process of tracking business-related travel, facilitating accurate expense reporting and reimbursements. By having immediate access to this information, users can better manage their time and resources, ultimately enhancing productivity and efficiency.

The ability to export data to various file formats is a vital feature for users seeking flexibility in managing their mileage records. This functionality allows users to convert their tracked data into formats such as CSV, Excel, or PDF, facilitating easier reporting and analysis. Moreover, accessible data formats enable seamless integration with accounting software or other financial management tools, enhancing overall efficiency and accuracy in record-keeping and tax preparation.

Yes, there are legal requirements for mileage tracking, particularly for tax purposes. In many jurisdictions, businesses and self-employed individuals must maintain accurate records of mileage driven for business activities to substantiate deductions. This typically includes documenting the date, purpose, starting and ending locations, and total miles driven. Failure to comply with these regulations may result in disallowed deductions and potential penalties during an audit. It is advisable to consult local tax laws for specific requirements.

Mileage tracking apps vary widely in cost, typically ranging from free to approximately $20 per month, depending on features and functionality. Basic applications may offer essential tracking capabilities at no charge, while more advanced options with integrated reporting, expense management, and GPS features often require a subscription. It is advisable to assess the specific needs of your mileage tracking to select an app that provides the best value and efficiency for your requirements.