Selecting the right broker for forex trading is a pivotal decision that can greatly influence a trader's performance and overall experience in the market.

With various types of brokers, such as market makers and ECN providers, understanding their distinct characteristics is essential for optimizing trading strategies.

Additionally, factors like regulatory compliance, platform usability, and customer support can significantly affect your trading journey. As we navigate through these critical considerations, one must ask: what specific attributes can truly make or break your trading success?

When selecting a forex broker, it is essential to understand the various types available and their respective roles in the trading ecosystem. Forex brokers can be categorized primarily into two types: market makers and ECN (Electronic Communication Network) brokers.

Market makers act as counterparties to traders, providing liquidity and setting bid-ask spreads, which can lead to conflicts of interest. Conversely, ECN brokers connect traders directly to the interbank market, facilitating transparent pricing and allowing for tighter spreads without dealer intervention.

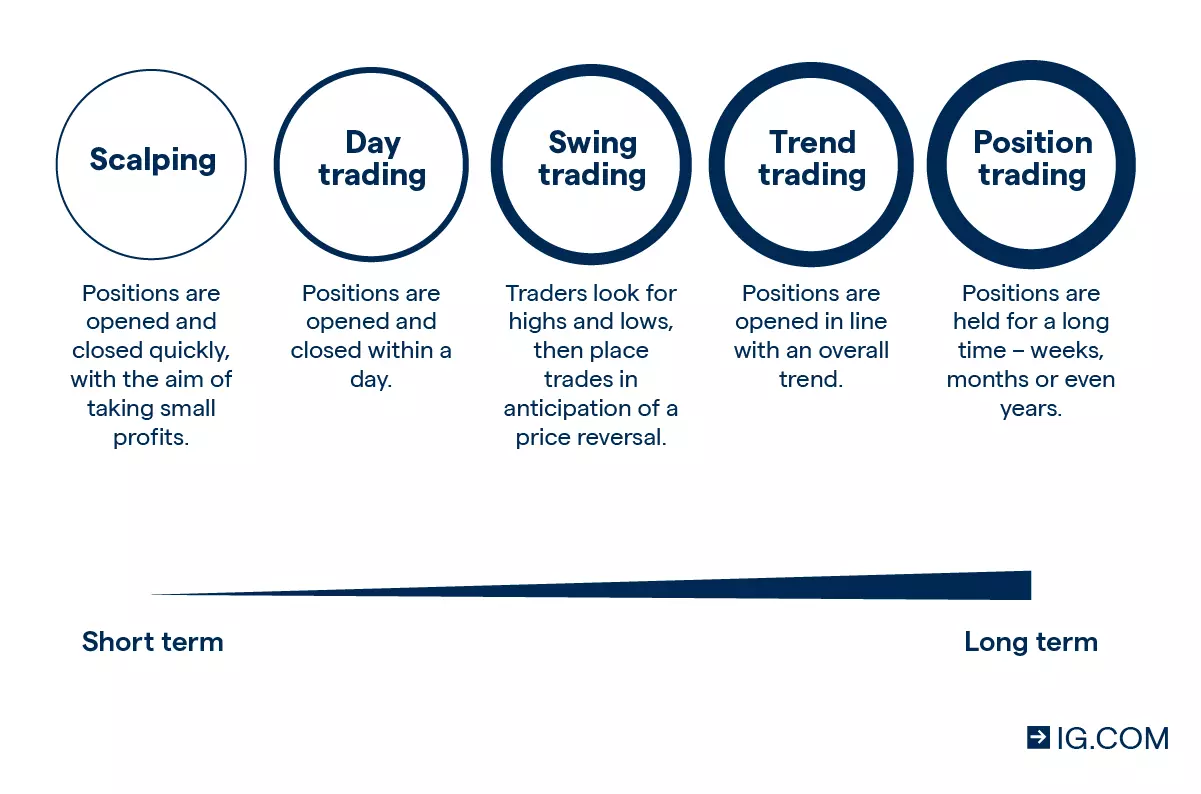

Each type serves distinct trading styles and strategies, influencing execution speed, costs, and overall trading experience. Understanding these differences is crucial for selecting the right broker to align with individual trading goals and preferences.

Selecting the right forex broker requires careful consideration of several key features that can significantly impact trading performance. First, assess the broker's regulatory status to ensure they operate under a reputable authority, which safeguards your investments.

Next, examine the trading platforms offered; a user-friendly, robust platform can enhance your trading experience. Additionally, consider the range of currency pairs available, as a diverse selection allows for more strategic trading opportunities.

Finally, evaluate customer support services, ensuring they are responsive and knowledgeable, as timely assistance can be crucial during market fluctuations. Making informed choices based on these features is essential for successful trading.

Understanding the different types of forex brokers is vital for traders looking to optimize their trading strategies. Generally, forex brokers fall into three main categories: market makers, ECN (Electronic Communication Network) brokers, and STP (Straight Through Processing) brokers.

Market makers provide liquidity by quoting both buying and selling prices, enabling traders to execute orders seamlessly. ECN brokers connect traders directly to the interbank market, offering tighter spreads and greater transparency. STP brokers, on the other hand, process orders directly to liquidity providers without any dealer intervention, ensuring faster execution and reduced slippage.

Choosing the right type of broker depends on individual trading styles, preferences for execution speed, and the need for transparency, making it essential for traders to assess these options thoroughly.

How crucial is regulatory compliance in the forex trading landscape? Regulatory compliance serves as a cornerstone for ensuring the integrity and security of the financial markets. Forex brokers that adhere to regulatory standards provide a layer of protection for traders, thereby fostering trust and transparency.

Compliance with authorities such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) ensures that brokers follow strict operational guidelines, safeguarding client funds and promoting fair trading practices.

Additionally, regulated brokers are subject to regular audits and scrutiny, which can mitigate risks of fraud or malpractice. Thus, selecting a broker with strong regulatory compliance is vital for traders seeking a secure and reliable trading environment.

The choice of a trading platform significantly impacts a trader's experience and success in the forex market. When evaluating platforms, consider factors such as user interface, speed of execution, and stability. A well-designed interface enhances usability, allowing traders to navigate charts and tools efficiently.

Speed of execution is critical, as delays can result in missed opportunities, especially in volatile markets. Additionally, assess the platform's compatibility with various devices; a robust mobile application can facilitate trading on-the-go.

Furthermore, look for features such as advanced charting tools, technical indicators, and automated trading capabilities, which can enhance trading strategies. Finally, ensure that the platform supports a range of trading instruments and offers flexible order types to accommodate diverse trading styles.

Effective customer support is crucial for traders, as timely assistance can significantly influence trading outcomes. When assessing customer support options, consider the availability of multiple contact channels, such as live chat, email, and phone support.

A broker that offers 24/7 assistance is particularly advantageous, given the global nature of forex trading. Additionally, evaluate the responsiveness and expertise of support staff, as knowledgeable representatives can resolve issues more efficiently.

Look for user reviews and testimonials to gauge the quality of support provided. An extensive FAQ section and educational resources can also enhance the overall support experience. Ultimately, choosing a broker with robust customer support can provide peace of mind and facilitate smoother trading operations.

The tax implications of forex trading can vary significantly based on jurisdiction and individual circumstances. Generally, profits derived from forex trading are subject to capital gains tax, while losses may be deductible. It is crucial for traders to maintain detailed records of their transactions for accurate tax reporting. Additionally, consulting with a tax professional who understands forex trading regulations is advisable to ensure compliance and optimize tax obligations effectively.

To determine if a broker is suitable for beginners, evaluate their educational resources, user-friendly trading platforms, and customer support. Look for brokers offering demo accounts that allow practice without financial risk. Additionally, assess the availability of beginner-friendly tools and features, such as simplified trading interfaces and comprehensive tutorials. Ensure they provide transparent fee structures and have a solid reputation within the trading community, which can significantly enhance the learning experience for novice traders.

Yes, you can trade forex on mobile devices. Most reputable brokers offer mobile trading applications that allow users to access the forex market conveniently from their smartphones or tablets. These apps provide essential features such as real-time quotes, charting tools, and the ability to execute trades. Mobile trading enhances flexibility, enabling traders to monitor their positions and make informed decisions while on the go, ensuring they remain engaged with the market at all times.