The EB5 investment immigration program presents a strategic opportunity for foreign investors aiming to secure permanent residency in the United States through substantial financial contributions.

Understanding the intricacies of the visa process, from investment requirements to the selection between Regional Centers and direct investment, is essential for making informed decisions.

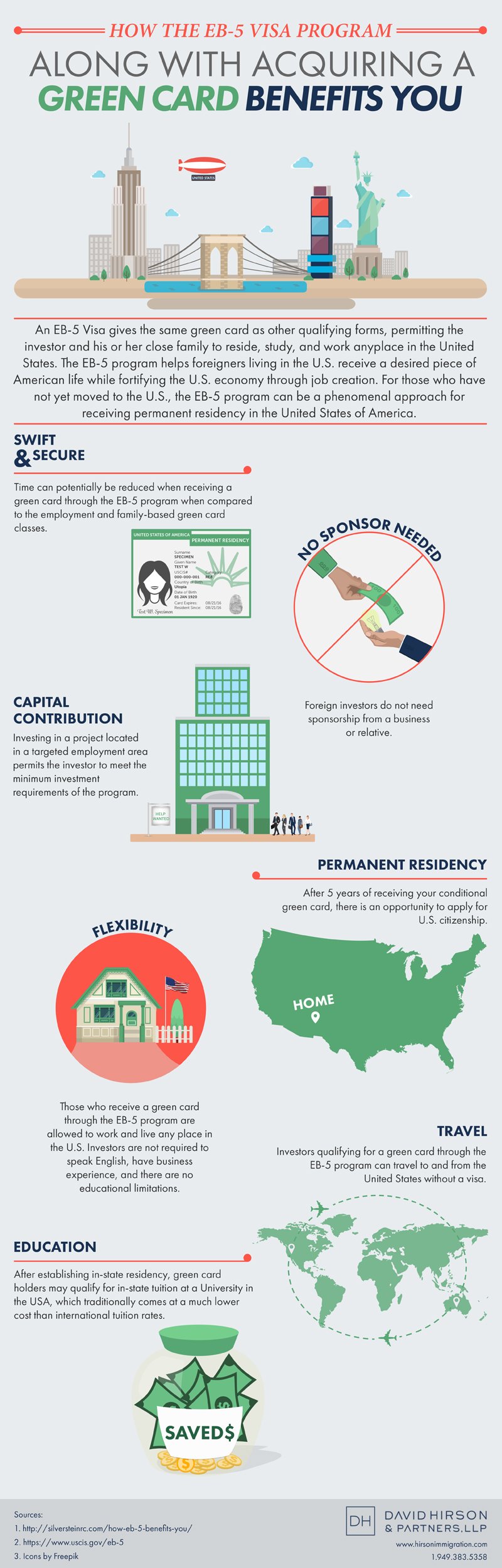

As potential applicants navigate this multifaceted landscape, they must also consider the numerous benefits accompanying a Green Card, alongside the challenges that may arise. The subsequent exploration of these elements will illuminate a pathway to realizing one's American dream.

The EB5 visa program offers a pathway for foreign investors to obtain U.S. permanent residency through significant investment in American business ventures. Established by the U.S. Congress in 1990, the program aims to stimulate the economy and create jobs.

Investors must demonstrate that their investment will lead to the creation of at least ten full-time jobs for American workers. The EB5 program primarily focuses on targeted employment areas, which are regions with high unemployment or rural locations, providing additional incentives for investment.

This visa not only allows investors to secure a green card but also their immediate family members. The EB5 visa is a unique opportunity that combines economic development with the personal aspiration of achieving the American dream.

To qualify for the EB5 visa, investors must meet specific financial requirements that ensure their commitment to the U.S. economy. The minimum investment amount is typically $1 million, although this is reduced to $500,000 if the investment is made in a targeted employment area (TEA), defined as rural or high-unemployment zones.

The funds must be at risk and used to create or preserve at least ten full-time jobs for U.S. workers within two years.

Investors can source their capital from various means, including personal savings, gifts, or business earnings, but must provide detailed documentation to prove the legitimacy of the funds. Compliance with these requirements is crucial for a successful EB5 application, demonstrating both financial commitment and economic contribution.

Navigating the application process for the EB5 visa requires careful attention to detail and adherence to specific protocols. The first step involves selecting a qualifying investment project, which can either be through a designated Regional Center or direct investment.

After identifying the project, applicants must prepare and submit Form I-526, Immigrant Petition by Alien Investor, along with supporting documentation that demonstrates compliance with the investment requirements. This includes proof of the investment amount, source of funds, and job creation projections.

Following approval of Form I-526, applicants can proceed to apply for conditional permanent residency through Form I-485 or consular processing. A thorough understanding of the necessary documentation and timelines is essential for a successful application.

When considering investment options for the EB5 visa, applicants must weigh the benefits and drawbacks of utilizing a Regional Center versus pursuing direct investment. Regional Centers offer a more hands-off approach, pooling funds from multiple investors to finance larger projects, which can simplify the job creation requirement.

They often have established track records and industry expertise, reducing the burden of active management for investors. In contrast, direct investment involves the investor taking a more active role in managing their business.

This option can yield greater control and potentially higher returns, but it requires substantial involvement and carries greater risk. Ultimately, the choice between Regional Centers and direct investment depends on the investor's risk tolerance, desired level of involvement, and overall investment strategy.

The EB5 immigration program offers numerous advantages for foreign investors seeking permanent residency in the United States, primarily through the creation of jobs and the infusion of capital into the economy.

Investors benefit from the opportunity to obtain a Green Card for themselves and their immediate family members, providing access to a high-quality education, advanced healthcare, and a stable environment. Additionally, the program fosters economic growth by supporting new and existing businesses, thereby enhancing community development.

Investors also gain the flexibility to live and work anywhere in the U.S., enjoying the diverse cultural and economic landscape. Furthermore, the EB5 program presents a pathway to U.S. citizenship, allowing for greater opportunities and security for investors and their families in the long term.

Embarking on the EB5 immigration journey can present various challenges that investors must navigate to achieve their goals. One significant hurdle is the lengthy processing times, which can lead to uncertainty. To mitigate this, applicants should ensure all documentation is meticulously prepared and consider engaging an experienced immigration attorney.

Another common challenge is the risk associated with the investment itself; investors should conduct thorough due diligence on Regional Centers and projects. Additionally, understanding compliance with U.S. Citizenship and Immigration Services (USCIS) regulations is crucial; staying informed through reliable sources can help.

Lastly, language barriers may impede communication; seeking translation services can facilitate smoother interactions. By proactively addressing these challenges, investors can enhance their chances of successfully obtaining EB5 status.

An EB5 lawyer can indeed assist with family immigration issues, particularly when those matters intersect with investment-based immigration. Their expertise encompasses not only the intricacies of the EB5 program but also the family-related immigration processes. This includes navigating visa applications for family members, addressing potential complications, and ensuring compliance with immigration laws. By leveraging their knowledge, an EB5 lawyer can help streamline the family immigration process, facilitating a smoother transition for all involved.

The cost of hiring an EB5 lawyer can vary significantly, typically ranging from $5,000 to $15,000, depending on the complexity of the case and the lawyer's experience. Some attorneys may charge additional fees for services such as document preparation or consultations. It is advisable to discuss fees upfront and ensure transparency regarding all potential costs involved in the EB5 visa application process to avoid any unexpected financial burdens later on.

The EB-5 application process typically spans 12 to 24 months, though timelines can vary based on individual circumstances and regional center processing times. After submitting the initial petition, applicants may experience delays due to the complexity of cases or additional requests for evidence. Moreover, the U.S. Citizenship and Immigration Services (USCIS) processing times can fluctuate, making it essential for applicants to remain informed and prepared throughout the duration of the process.