Estate planning is a critical yet often misunderstood aspect of financial management, and the involvement of an attorney can greatly enhance the experience.

By leveraging their expertise in estate laws, attorneys guide clients through the complexities of drafting wills, trusts, and other essential documents, ensuring that individual goals are met while minimizing potential pitfalls.

However, many individuals are unaware of the full spectrum of benefits that a qualified attorney can provide. Understanding these advantages is essential for anyone considering their estate planning options, particularly as they navigate the intricacies of personal and legal requirements.

Many individuals may find estate planning to be a complex yet essential aspect of managing their assets and ensuring their wishes are honored after their passing.

Estate planning involves the process of organizing and documenting how an individual's assets will be distributed, managed, and utilized upon their death or incapacitation. This includes creating wills, trusts, and directives that specify beneficiaries and designate guardians for dependents.

Effective estate planning takes into account various factors, such as tax implications, debt management, and the unique needs of beneficiaries. It aims to minimize disputes among heirs, reduce estate taxes, and ensure that personal wishes are fulfilled. Ultimately, understanding estate planning is vital for anyone who wishes to secure their legacy and protect their loved ones.

Engaging an attorney for estate planning can significantly enhance the effectiveness of the process. Attorneys possess specialized knowledge of the complex legal frameworks surrounding estate laws, ensuring that your documents are compliant and valid.

They can provide tailored advice based on your unique circumstances, helping you navigate various options such as trusts, wills, and tax implications. Additionally, an attorney can identify potential pitfalls and address them proactively, minimizing the chances of future disputes among heirs.

Their expertise also extends to updating documents as laws change or your personal situation evolves. Ultimately, hiring an attorney not only fosters peace of mind but also ensures that your estate plan reflects your wishes accurately and is executed smoothly.

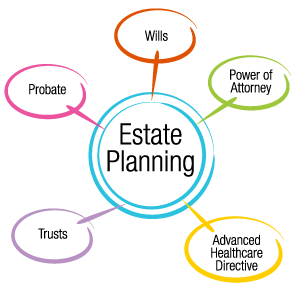

Estate planning typically involves several key documents, each serving a distinct purpose in ensuring that an individual's wishes are honored after their passing.

The most common documents include wills, which outline the distribution of assets; trusts, which can provide tax benefits and facilitate asset management; and powers of attorney, granting authority to manage financial or medical decisions if one becomes incapacitated.

Additionally, healthcare directives specify preferences for medical treatment, ensuring that personal values guide decisions when one is unable to communicate. Beneficiary designations on financial accounts and insurance policies ensure that assets are transferred directly to intended recipients. Each of these documents plays a crucial role in creating a comprehensive estate plan tailored to individual needs and circumstances.

Navigating the complexities of estate planning can be daunting, especially when it comes to understanding the various documents and legal requirements involved. Attorneys play a crucial role in simplifying this process by providing expert guidance tailored to individual needs.

They assist clients in identifying their goals and objectives, ensuring that all necessary documents, such as wills, trusts, and powers of attorney, are properly drafted and executed. Additionally, attorneys stay updated on the latest laws and regulations, helping clients avoid common pitfalls and misunderstandings.

By offering personalized advice, they alleviate the emotional burden often associated with estate planning. Ultimately, the expertise of an attorney transforms a potentially overwhelming task into a manageable and efficient experience, allowing clients to secure their legacy with confidence.

Selecting the right attorney for your estate planning needs is a critical decision that can significantly impact your financial future and the welfare of your loved ones. Begin by seeking an attorney with specialized expertise in estate planning, as they will be well-versed in the complexities of wills, trusts, and probate laws.

Schedule consultations to assess their communication style, responsiveness, and willingness to address your specific concerns. Additionally, review their credentials, including certifications and professional affiliations, to ensure they possess the necessary qualifications.

Personal recommendations and online reviews can provide valuable insights into their reputation and effectiveness. Ultimately, choosing an attorney who prioritizes your goals and demonstrates a deep understanding of your unique situation will facilitate a more effective estate planning process.

Many individuals hold misconceptions about estate planning that can hinder their ability to create an effective plan. One prevalent myth is that estate planning is only for the wealthy; however, it is essential for anyone wishing to ensure their assets are distributed according to their wishes.

Another common belief is that estate planning is a one-time event, but it requires regular updates to reflect life changes. Additionally, some people assume that a will alone suffices, neglecting the potential benefits of trusts and other instruments.

Lastly, many believe that estate planning is solely for after one's death, overlooking the importance of designating powers of attorney and healthcare proxies for incapacitation. Addressing these misconceptions can empower individuals to engage in comprehensive estate planning.

Estate planning can safeguard assets in the event of a beneficiary's divorce or bankruptcy by utilizing trusts, prenuptial agreements, and careful structuring of inheritances. Placing assets in trust can protect them from being considered marital property during a divorce settlement. Similarly, prenuptial agreements can outline the treatment of assets in case of divorce. Careful planning ensures that assets are shielded and preserved for intended beneficiaries regardless of external circumstances.

When it comes to estate distribution, some lesser-known tax implications can have a significant impact on the assets passed down to heirs. Strategies such as considering the step-up in basis rules, utilizing charitable deductions, and gifting assets during one's lifetime can help minimize these tax implications. By working with knowledgeable estate planning attorneys and staying informed about tax laws, individuals can navigate these complexities and ensure more efficient estate distribution.

In estate planning, specific considerations arise for blended families or non-traditional family structures. Ensuring that assets are distributed as intended can be complex due to diverse familial dynamics. Addressing potential conflicts and clearly outlining beneficiaries is crucial. Trusts can be valuable tools to provide for different family members and protect assets. Consulting with a knowledgeable estate planning advisor can help navigate these unique situations and create a tailored plan that reflects individual circumstances.